BankShift Promo Video – Financial Institutions

As 2024 approaches its mid-point, we face a digital banking landscape filled with uncertainty. Much like in 2023, the economy is sending mixed signals: inflation is not declining, interest rates remain high, and various economic indicators suggest a potential slowdown on the horizon.

We look forward to what we can achieve with a smart strategy, a dedicated team, and a strong commitment to execution.

We choose to embrace the potential of economic uncertainty. However, we must approach this with realism and clear vision, prepared to navigate the headwinds ahead by focusing on the right priorities.

At BankShift, we empower small to medium-sized financial institutions to innovate affordably by integrating advanced banking-as-a-platform technology that reduces risk, lowers operational costs, and enhances customer financial well-being. We offer income-generating financial products, pay-by-bank, and other efficient payment methods with transaction biometrics, ensuring institutions can scale effectively, maintain customer trust, and navigate the evolving financial landscape with confidence and safety.

With this in mind, we’re sharing our 18-month roadmap that’s focused on three imperatives that we believe are crucial for small and mid-sized financial institutions to drive both immediate and long-term growth.

- Affordability with a light API Gateway

Context: Managing a complex network of vendors strains resources and affects customer service for financial institutions.

Imperative: Provide a light-weight API gateway for real-time vendor monitoring, reducing call center burdens and enhancing operational efficiency. This solution will lower operational costs and facilitate seamless technology integration, leveling the playing field for smaller institutions.

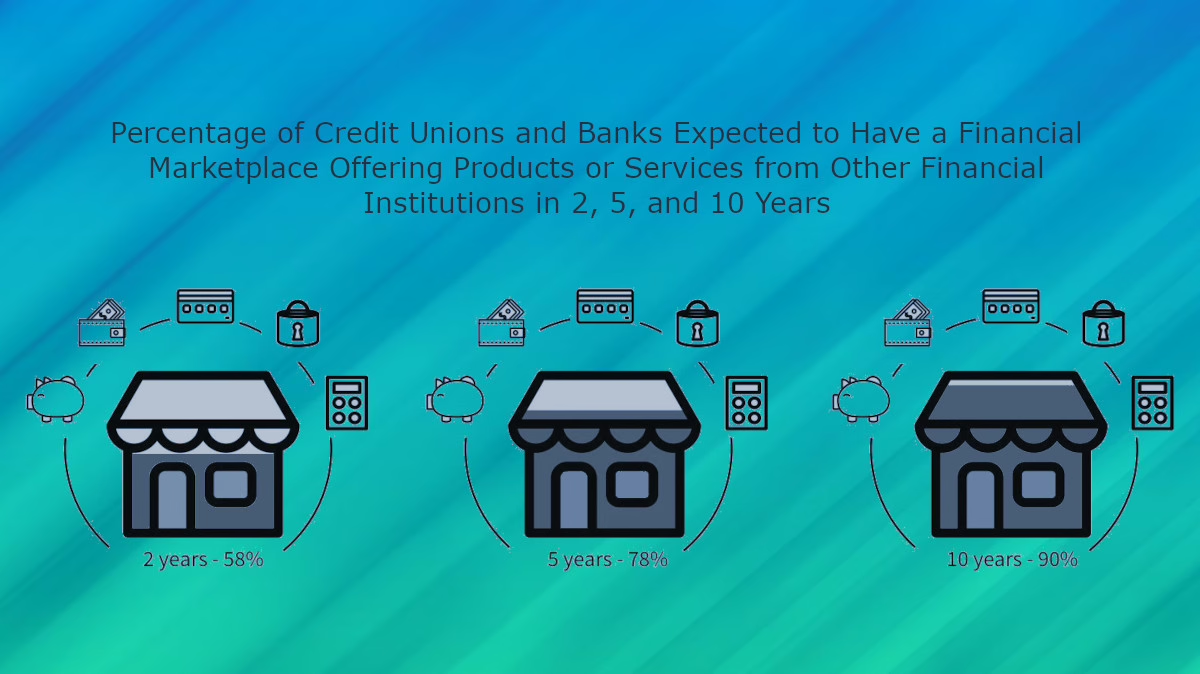

- Empowering Digital Transformation with Income-Generating Products

Context: Many institutions lack the infrastructure and resources for a digital transformation.

Imperative: Develop a comprehensive digital banking platform offering affordability, flexibility, scalability, and seamless integration with existing systems. Introduce products which promote financial well-being; such as savings plans and investment opportunities, which prioritize income generation over debt.

- Brand On Banking Customer Acquisition

Context: In the challenging economic environment of today, differentiation is crucial for small to medium-sized financial institutions and their brand partner merchants.

Imperative: Enhance and promote brand-on-banking technology, enabling brands to integrate their services within a financial institutions’ ecosystems. Implement and promote cost-saving payment solutions, providing benefits to merchants and encouraging efficient payment methods through banks and credit unions.

Conclusion:

We envision a future where financial institutions of all sizes can harness cutting-edge digital technology to transform operations, offer innovative financial products, and build lasting customer relationships. Through strategic partnerships and advanced financial branding technology, we aim to empower our clients to redefine banking and navigate future challenges with confidence. Contact us today!

About BankShift:

BankShift is a digital banking platform created by experienced professionals renowned for their expertise in digital transformation and innovation at a top 5 financial institution. It also includes a patent-pending acquisition and loyalty system that harnesses financial technology to allow businesses to incorporate their brand atop a financial institution. Our software will help financial institutions lower their costs, diversify their revenue streams, reduce digital compliance efforts and cultivate empathetic loyalty among their members.