Branded Banking Loyalty

A turnkey platform that shifts Gen Z back to credit unions by finishing what co-branded cards started. Delivering branded, embedded banking experiences that drive revenue, deepen loyalty, and spark next-gen engagement.

Banking Platform Features

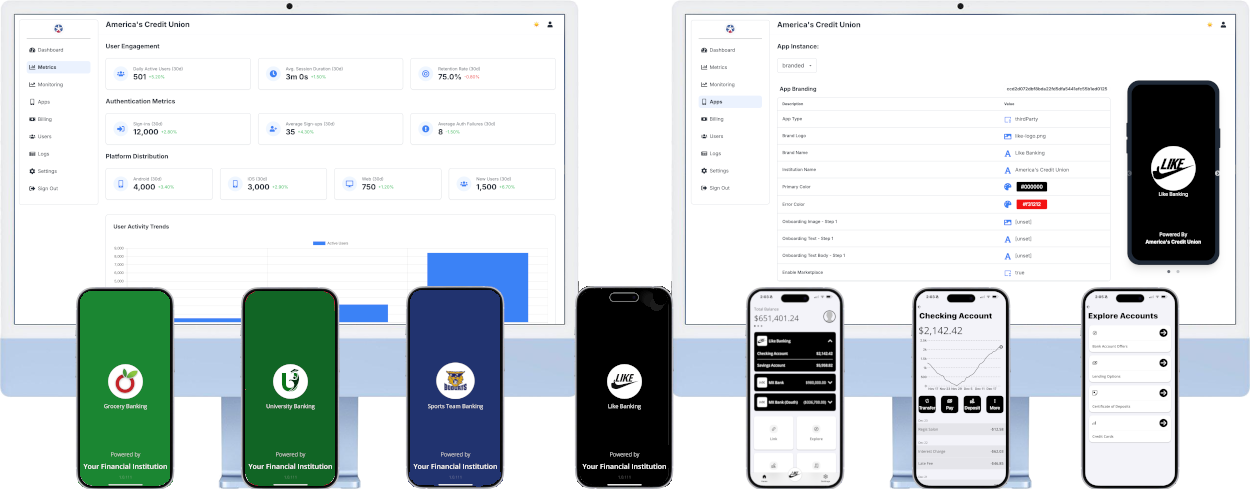

Observability

Monitor real-time vendor performance and system health through our unified API gateway and admin portal, reducing support load and increasing operational clarity.

Manageability

Easily configure and update experiences with intuitive web panels, integrated SDKs, App Studio, and APIs, simplifying frontend changes without lengthy development cycles.

Brandability

Embed loyalty-driven branded banking using our no-code platform, enabling tailored financial experiences inside third-party apps without complex integrations.

Embedded Marketplace

Our platform connects to your existing vendors for real-time payments, advanced fraud detection, and secure transfer check, ensuring safety while providing streamlined, frictionless embedded banking experiences for smooth adoption and lasting engagement.

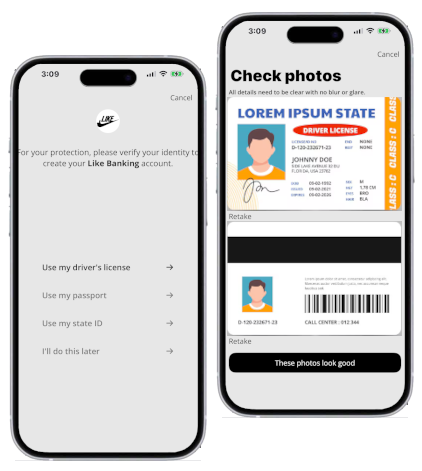

Digital Acquisitions

Embedding branded financial services into apps for effortless consumer acquisition and loyalty.

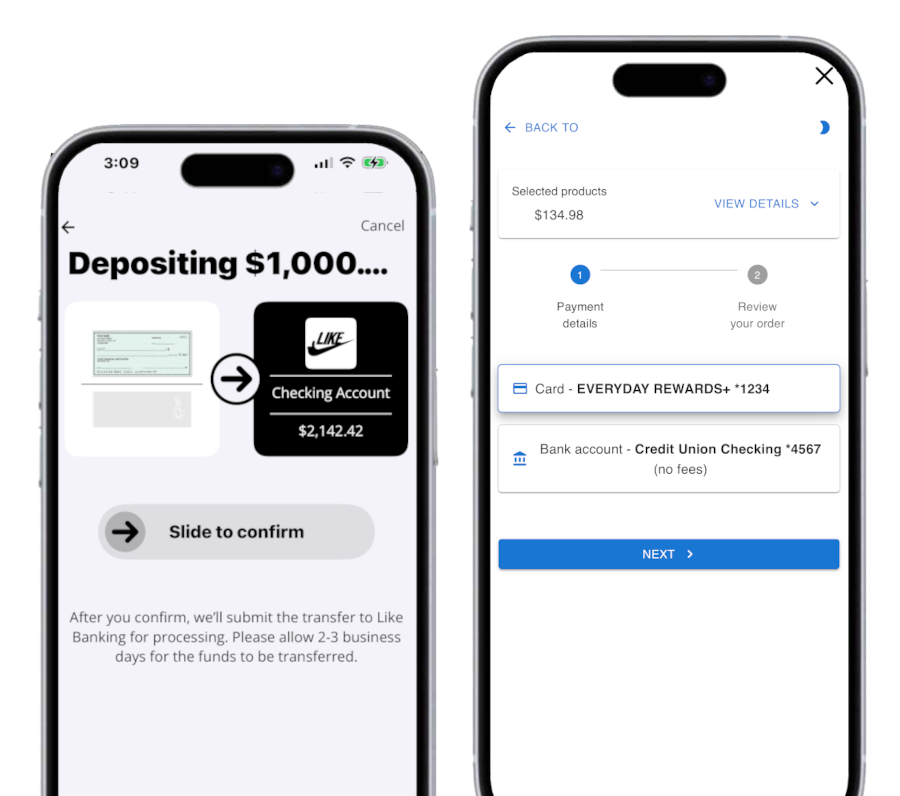

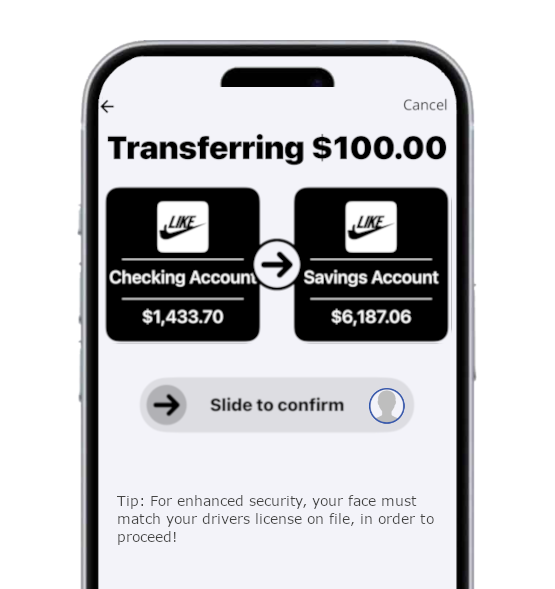

Frictionless Payments

Proven all-in-one account platform with seamless real-time payments for enhanced service.

Fraud Prevention

Advanced fraud detection during onboarding and secure transfer monitoring for safety.

Branded Experiences

Streamlined banking experiences that reduce friction for smooth adoption and sticky use.

The Gen Z Money Mindset

Engage Gen Z where they are with modular plugins—featuring a fidget spinner credit score and game-inspired menus. Deliver seamless, branded banking journeys from account opening to servicing with BankShift’s low-code platform for fast, simple integration.

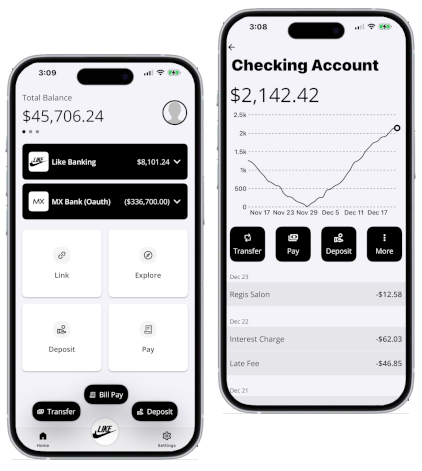

1

One Place

2

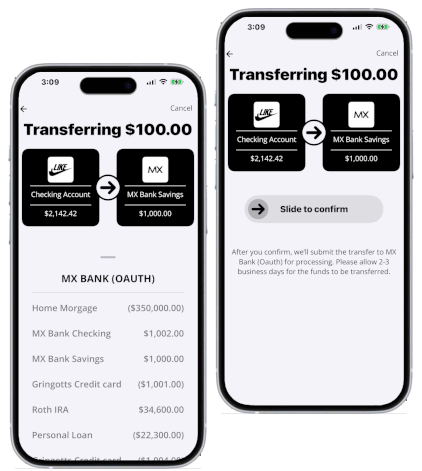

Money Movement

3

Account Opening

Lower High Risk Transactions

Embrace a Know Your Customer (KYC) verification flow that flags high-risk transactions, triggers secure selfie-to-driver’s license authentication, ensures transaction security, captures payment revenue, and prevents fraud.

Deposits and Payments

BankShift unlocks the full revenue potential of your deposits and payments without costly core migrations, complex digital transformations, or additional technical resources. Our platform enhances engagement, optimizes payments, ensures your compliance, and drives continuous innovation seamlessly.