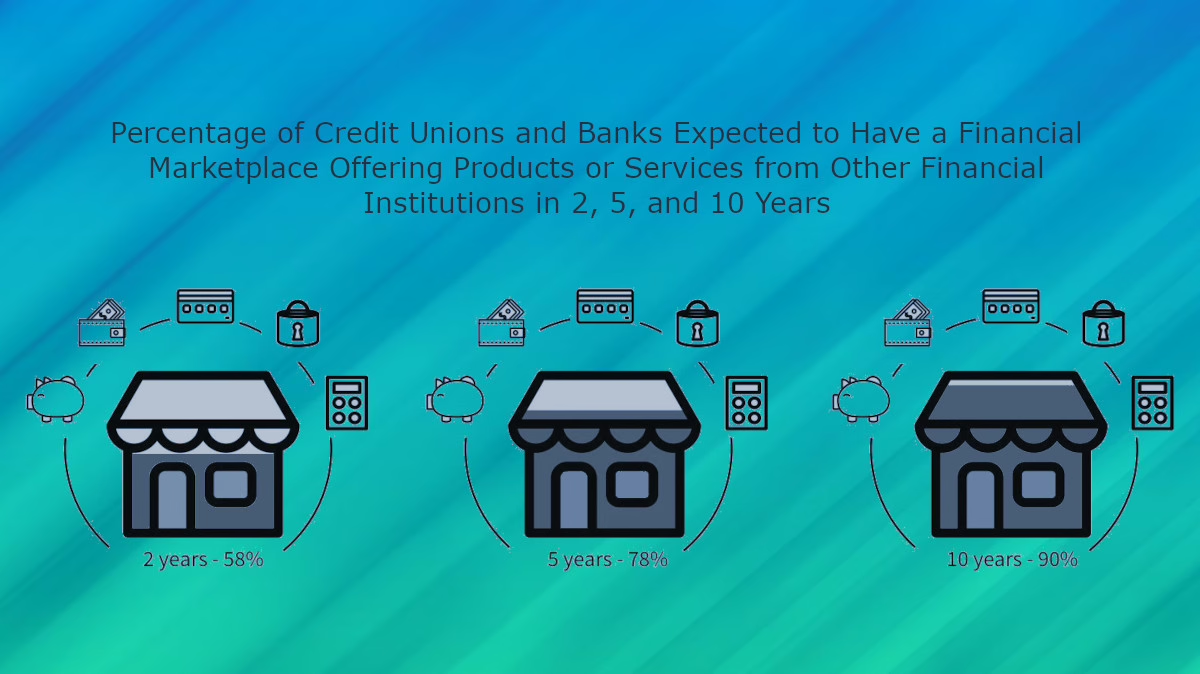

At BankShift, we’re closely monitoring the evolving landscape of financial marketplaces and their impact on the industry. Recent research from leading consulting firms sheds light on the trends and expectations for financial institutions in the coming years. Here’s a snapshot of what to expect:

2-Year Projection (2024):

Financial institutions are increasingly exploring or implementing open banking and financial marketplaces. According to Deloitte, open banking is rapidly gaining traction, particularly in Europe and the UK, with US banks starting to follow. Institutions are forming partnerships to recalibrate customer relationships and enhance service offerings through these ecosystems.

For more details, check out Deloitte’s insights [here].

5-Year Projection (2029):

By 2029, the majority of financial institutions are expected to have integrated financial marketplaces into their services. McKinsey anticipates a significant shift towards digital transformation, with financial institutions becoming central hubs in a broader ecosystem. This will involve not only sharing customer data with third parties but also receiving data to create a more integrated and comprehensive financial service model.

Explore McKinsey’s predictions [here].

10-Year Projection (2034):

Looking ahead to 2034, the integration of financial marketplaces is likely to become standard practice globally. The trend towards embedded finance and comprehensive service platforms will solidify, with institutions offering a wide array of services from various partners. This shift will be driven by the demand for seamless, personalized, and holistic financial services.

For further insights, Deloitte’s outlook is available [here].

Additional Resources:

McKinsey on embedded finance and trade-offs for US banks: [Read more].

Accenture Banking Marketplace: [Download the report]

Speaking of marketplaces, stay tuned as we continue to explore how BankShift, delivered through the AWS Marketplace, is positioned to help credit unions and community banks navigate these changes and leverage the potential of their own financial marketplaces.

About BankShift:

BankShift is a brand-on-banking ecosystem operating under a banking-as-a-platform model, designed by experts with deep experience in digital-first and data-driven innovations. Our platform, featuring patent-pending technology, harmonizes brands with banking, enabling credit unions and community banks to embed their digital banking within third-party apps. This approach creates new revenue streams, enforces compliance, and builds empathetic loyalty among members, customers, and fans.