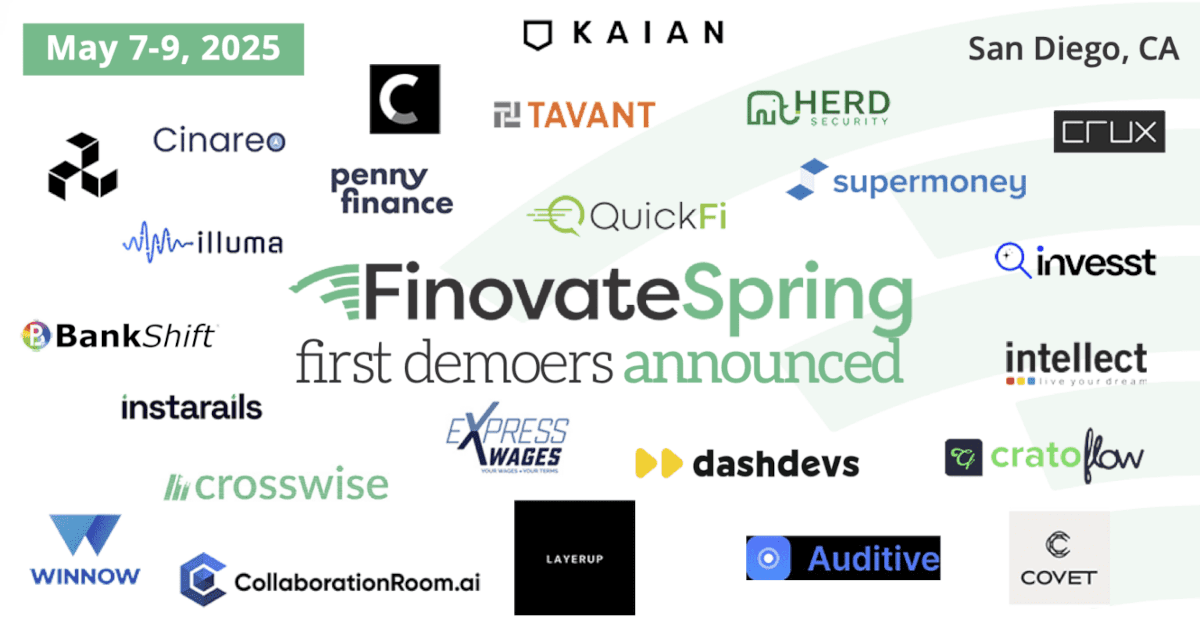

Following a standout appearance at the recent Finovate Spring conference, BankShift is accelerating the digital transformation of credit unions and community banks with its innovative Banking on your Brand technology, now available via AWS Marketplace for financial institutions.

BankShift’s platform enables financial institutions to seamlessly embed digital banking services directly into popular brand apps-meeting Gen Z and Millennial consumers where they already spend their time. This approach empowers credit unions and community banks to generate new revenue streams, enforce compliance, and build deeper loyalty by integrating banking into non-financial digital platforms.

Key Features and Industry Impact

- Embedded Banking for Brands: BankShift’s technology allows financial institutions to integrate their services into third-party brand apps, delivering unified digital experiences and loyalty rewards that resonate with younger consumers.

- Low-Code Integration: The platform offers low-code tools for rapid deployment, including account aggregation, secure transfers, and real-time payments-all accessible within the brand’s existing app environment.

- Flexible Deployment: Available on AWS Marketplace, BankShift supports both turnkey and customized implementations, giving institutions the flexibility to scale and adapt as their digital strategies evolve.

- Cost and Compliance Benefits: By shifting to embedded banking, credit unions and banks can reduce operational costs, streamline compliance, and deepen member relationships-critical advantages in a market facing increased regulatory pressure and competition from neo-banks.

Meeting the Moment: Why Now?

The surge in embedded finance has left many smaller institutions searching for ways to keep pace. BankShift’s Brand-on-Banking model levels the playing field, letting community banks and credit unions offer the same seamless, digital-first experiences without the need for costly core migrations or lengthy transformation projects. Gen Z and Millennials crave loyalty rewards and want to bank where they already are. BankShift makes that possible, giving institutions a new way to engage, reward, and retain their members.

Looking Ahead

With a growing roster of credit union and banks, BankShift is poised to make a significant impact on the embedded banking platform market. The company invites financial institutions to pilot its technology-with entry points as low as $500-ish/month-signaling a commitment to accessible, scalable innovation for all.

With a growing roster of credit union and banks, BankShift is poised to make a significant impact on the embedded banking platform market. The company invites financial institutions to pilot its technology-with entry points as low as $500-ish/month-signaling a commitment to accessible, scalable innovation for all.

About BankShift

BankShift is an embedded banking platform built on a banking-as-a-platform model, designed by experts in digital-first innovation. Featuring patent-pending technology, BankShift enables credit unions and community banks to seamlessly integrate banking products into traditionally non-financial experiences. The platform empowers financial institutions and third-party brands to unlock new revenue streams, maintain regulatory compliance, and foster authentic consumer loyalty. By redefining the way financial services blend within brand experiences, BankShift creates lasting connections that enhance engagement and elevate everyday financial experiences.

For more information, visit bankshift.com.