The late nights, the weekend grind, and the all-in commitment have all led to this: BankShift is officially launching on AWS Marketplace. This isn’t just another automation milestone, it’s a major shift for credit unions, community banks, and brands looking to bring embedded banking to life without the hassle of a core banking overhaul or a massive tech build.

Frictionless Access to Embedded Banking

With our AWS Marketplace launch, getting started has never been easier. Whether you need a plug-and-play branded banking solution or a custom-built embedded banking strategy, BankShift gives you the flexibility to scale on your terms. Our solution is compliant, secure, and runs behind your own AWS tenant, ensuring seamless integration with your existing infrastructure.

Here’s What That Means for You:

- Embed financial products directly into brand partners’ web and mobile apps

- Go to market faster with pre-configured, compliance-ready SDKs

- Unlock new revenue streams while increasing customer loyalty and engagement

- Deliver next-gen banking experiences without a complex internal tech build

Where Embedded Banking Comes to Life

BankShift was built for credit unions and community banks and their brand partners looking to deepen consumer relationships and unlock new revenue streams. Here’s how different industries are already thinking about putting embedded banking it to work:

- Retail & E-commerce – Branded financial products that drive loyalty and repeat purchases

- Sports & Entertainment – Embedded banking to deepen fan engagement and reduce payment processing costs

- Travel & Hospitality – Integrated rewards, payments, and banking for a seamless experience

- Grocery & Supermarkets – Embedded banking for free food incentives, boosting customer retention

- Universities & Students – Embedded banking for tuition payments and student perks

Protecting Our Brand, Strengthening Yours

As we scale, we’re not just innovating, we’re committed to owning the space to better serve our customers. To reinforce our leadership, both BankShift® and our slogan Banking On Your Brand® are now registered trademarks, while we’ve also filed non-provisional patents and international provisional patents to safeguard our innovations. This legal protection helps ensure exclusivity, supports our global expansion, and strengthens trust with our partners and customers.

Meet Us at These Events

We’re hitting the road in 2025 to showcase what’s possible with embedded banking done right. Join us at:

📍 Fintech Meetup – Las Vegas, Nevada (Mar 10-13)

📍 VeleraLive – Denver, Colorado (Apr 14-16)

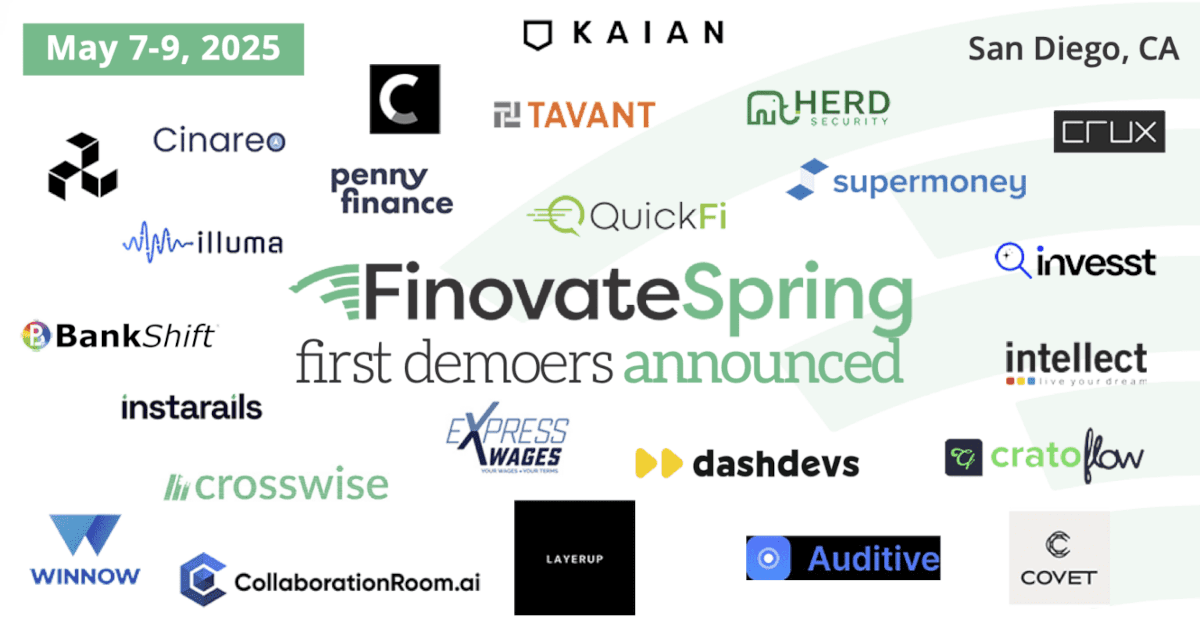

📍 Finovate – San Diego, California (May 7-9)

📍 TAO Fintech – Portland, Oregon (tbd)

Want to connect? Book a meeting with our CEO, Rob Thacher, at any of these events to explore how BankShift can help you build the future of embedded banking inside popular brand experiences.

Old Banking Core? No Problem. No Tech Team? We Got You.

For credit unions and community banks that don’t have the means and resources for a full-scale digital transformation, BankShift makes it easy. No need for a core banking upgrade. No need to hire a large tech team. We provide the infrastructure, security, and compliance—so you can focus on what matters most: your members and customers.

All you need:

✅ An AWS Cloud Account. Current Banking Vendors, A web browser, iOS, or Android device

✅ Your current employees, as this platform was made for them specifically.

✅ A vision for embedding your banking services in a brands app, just like the Walmart news.

March is Coming. Get Ready for What’s Next

The launch of BankShift on AWS Marketplace is just around the corner, and with it comes a new era of frictionless embedded banking. Stay tuned for what’s next, as we have a new disaster recovery model, for those uncertain times.

About BankShift:

BankShift is an embedded banking platform built on a banking-as-a-platform model, designed by experts in digital-first innovation. Featuring patent-pending technology, we enable credit unions and community banks to seamlessly integrate banking products into traditionally non-financial experiences. Our platform empowers financial institutions and third-party brands to unlock new revenue streams, maintain regulatory compliance, and foster authentic customer loyalty. By redefining the way financial services blend with brand experiences, we create lasting connections that enhance consumer engagement and elevate everyday financial interactions.