Banking transformation shouldn’t take decades—or require a complete tech overhaul. With BankShift, you can launch embedded banking now without replacing your core system or hiring a massive tech team. Get ahead of the big banks and start delivering next-gen financial experiences that drive engagement, revenue, and loyalty today.

Frictionless Embedded Banking—No Overhaul Required

Traditional banking transformations can be slow, costly, and disruptive. BankShift eliminates the friction, empowering credit unions, community banks, and brands to seamlessly integrate financial services. Our plug-and-play model runs securely behind your AWS tenant, ensuring compliance while giving you full control. And for institutions looking beyond AWS, we’re building an active-active cross-cloud model with Azure—so you’re always operational.

What This Means for Credit Unions and Community Banks

✅ No core replacement – Keep your existing systems and add embedded banking effortlessly (unless your core is at end-of-life).

✅ Go live faster – Pre-built, compliance-ready SDKs for web & mobile.

✅ New revenue streams – Increase engagement and drive profitability for your institution.

✅ Turnkey infrastructure – Secure, compliant, and available for immediate deployment in AWS Marketplace.

✅ Gen Z-focused features – Interactive credit score spinner & selection wheel for better financial engagement.

✅ Open Banking integration – Give users a unified view of all their accounts—helping them manage finances with ease.

✅ Pay by transfer – Reduce merchant fees while offsetting costs with BankShift.

✅ Vendor Secrets Management – Easily connect to your existing providers by adding your key & secret.

✅ OpenID integration – Seamlessly connect to your existing identity provider.

✅ Transfer Lock security – External transfers require a selfie match to a driver’s license for enhanced fraud prevention.

✅ Real-Time Payments – A seamless experience from onboarding to transactions.

✅ Web & Mobile Management – Update iOS, Android, and web experiences from a single admin portal.

✅ API Monitoring & Alerts – Identify and resolve issues before your members notice.

✅ Feature Toggles – Introduce new products & services instantly, with no downtime.

✅ Push-Button Upgrades – Stay on the latest version automatically—no more “who’s on first?” confusion.

✅ Real-Time Metrics – Get instant visibility into data, instead of waiting 24 hours.

✅ Role-Based Access – Ensure compliance and avoid costly regulatory fines.

✅ System Logging – Track account activity for better security and transparency.

✅ Break-Glass Failover – Maintain uninterrupted mobile banking services, even during outages.

Where Embedded Banking Comes to Life

Organizations across industries are integrating BankShift to create immersive, Gen Z-friendly financial experiences:

🏪 Retail & E-commerce – Branded financial products that drive loyalty.

🏆 Sports & Entertainment – Embedded banking to deepen fan engagement.

✈️ Travel & Hospitality – Integrated payments & rewards for frictionless transactions.

🛒 Grocery & Supermarkets – Banking incentives to boost customer retention.

🎓 Universities & Students – Tuition payments & exclusive financial perks for students.

Protecting Our Brand. Strengthening Yours.

To reinforce our leadership, BankShift® and Banking On Your Brand® are now registered trademarks. We’ve also filed non-provisional and international provisional patents, securing our innovations for global expansion.

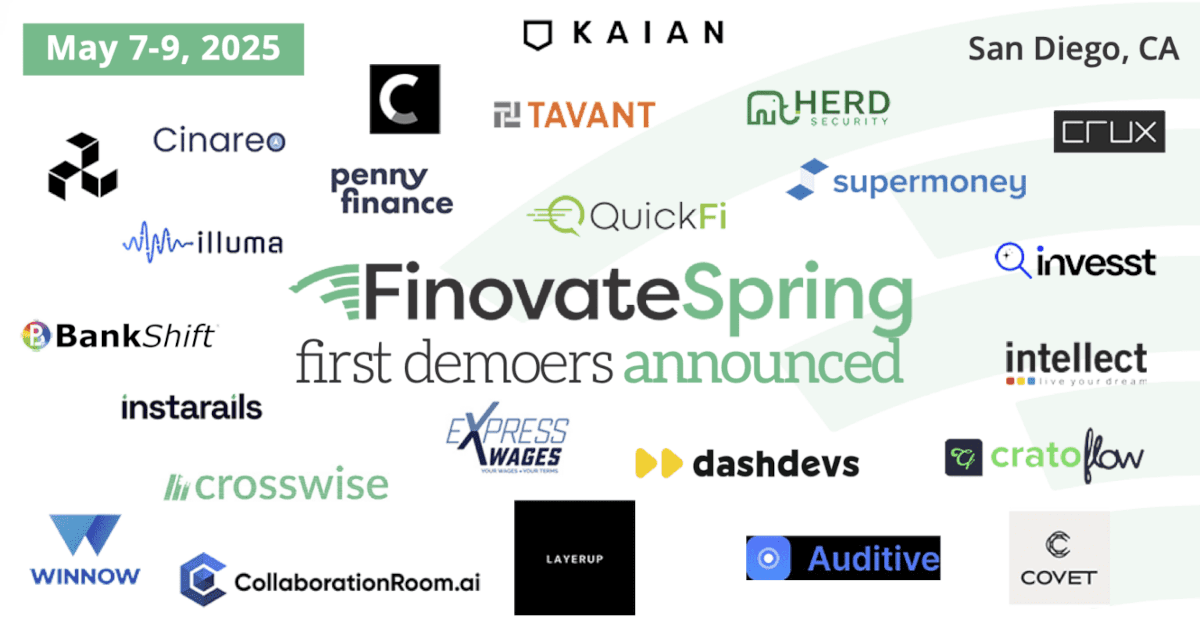

Meet Us at These Events

Join us as we showcase how easy embedded banking can be—no core banking overhaul required:

📍 TAO Fintech – Portland, OR (April 3rd)

📍 VeleraLive – Denver, CO (April 14-16)

📍 Finovate – San Diego, CA (May 7-9)

Want to connect? Book a meeting with our leadership team to see how BankShift can help you go live before the big banks do.

No Core Upgrade? No Tech Team? No Problem.

All you need to get started:

✅ An AWS Cloud Account and your existing banking vendors.

✅ Your current team—BankShift was built to empower them.

✅ A vision for embedding banking into brand experiences.

Embedded banking is moving fast—don’t wait for a digital transformation to catch up. The future of financial services is happening now, and BankShift makes it easier than ever. Here’s some fun facts.

About BankShift

BankShift is an embedded banking platform built by digital-first fintech experts. Designed on a banking-as-a-platform model, our patent-pending technology enables credit unions, community banks, and brands to embed financial products without massive infrastructure changes.

We help financial institutions unlock new revenue, stay compliant, and build authentic customer loyalty. By blending banking with brand experiences, BankShift is redefining how people engage with financial services.

Let’s build the future of embedded banking—together. 🚀