As we turn four, it’s impossible not to reflect on the journey that has brought us to this milestone. These past four years have been a testament to resilience, determination, and the support of an incredible network of people and organizations who believed in our vision. Building in the banking and fintech space, especially as a bootstrapped company, has not been without its challenges. The road was steep, filled with complex regulatory hurdles and the constant pressure to deliver at the highest level. But every obstacle has only reinforced our commitment to empowering credit unions and community banks with the technology they need to not only survive but lead.

We set out with one mission: to help these institutions maintain their legacy of white-glove service while evolving for Millennials and Gen Z, who demand seamless, digital-first experiences. We wanted to prove that smaller, local financial institutions can compete with big banks, not just by offering personal service, but by delivering innovative, tech-driven solutions.

We didn’t get here alone. To everyone who has been a part of this journey, whether by offering your time, insight, or commitment to our mission, we thank you. The partnerships we’ve built with forward-thinking people and companies have been instrumental in getting us to this point. You’ve helped us shape a future where credit unions can continue to serve their communities with the same care and loyalty they’ve always shown, but in a way that resonates with younger generations.

Your trust in us, your willingness to collaborate, and your belief in what we’re trying to achieve have been invaluable. Thank you for helping us make a difference. As we step into the future, we remain more dedicated than ever to supporting credit unions and community banks in delivering the best of both worlds—personalized service powered by cutting-edge technology. Here’s to the next chapter, together.

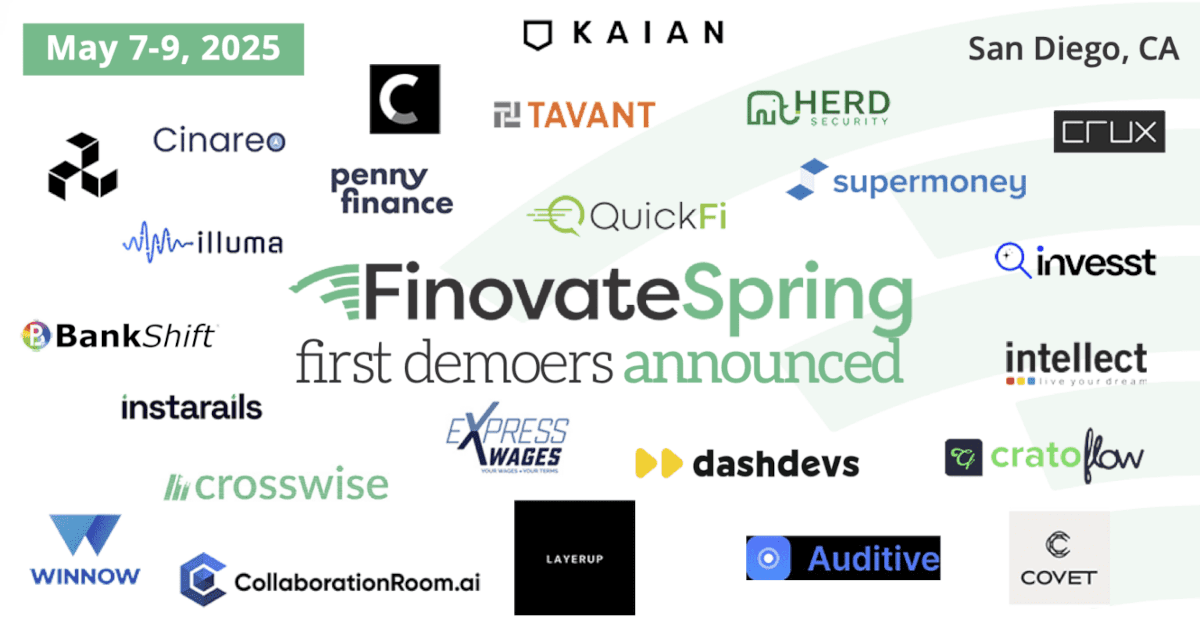

About BankShift:

BankShift is a brand-on-banking ecosystem operating under a banking-as-a-platform model, designed by experts with deep experience in digital-first and data-driven innovations. Our platform, featuring patent-pending technology, harmonizes brands with banking, enabling credit unions and community banks to embed their digital banking within third-party apps. This approach creates new revenue streams, enforces compliance, and builds genuine loyalty among members, customers, and fans.